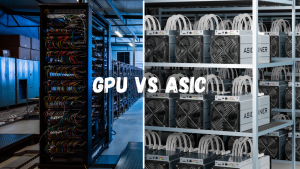

An Analysis of ASIC vs GPU Crypto Mining

If you’re interested in profitable cryptocurrency mining, the mining hardware you choose is arguably the most important decision. The two primary options to consider are Application-Specific Integrated Circuit (ASIC) miners or Graphics Processing Unit (GPU) miners. But which is better for crypto mining – ASICs or GPUs? Let’s analyze the key factors.

Introduction to ASIC and GPU Miners

First, what exactly are these types of hardware and what are their origins?

ASIC Miners: As the name suggests, ASICs are customised hardware chips designed specifically for the SHA-256 hashing algorithms used in Bitcoin and some other cryptos. Major manufacturers include Bitmain, MicroBT and Canaan.

GPU Miners: Graphics processing unit chips handle rendering complex visuals. For crypto mining purposes, high-end units from AMD and Nvidia are reconfigured to calculate mining algorithms. These were the first type used.

Now that we understand what they are under the hood, let’s compare them across some vital mining performance metrics:

Hash Power and Efficiency

In simple terms, hash power denotes the speed and capability for validating cryptocurrency transactions to earn rewards. The unit for measuring is Megahashes per second or Terahashes per second (MH/s and TH/s).

In raw hash power and efficiency, ASICs are the undisputed champions. The latest generation ASICs boast hash rates from 50 TH/s up to a blazing 110 TH/s per unit. Compared to top-line GPUs in the 50-60 MH/s range, a single ASIC equals hundreds of GPUs! This massive advantage makes profitability effortless even with high hardware costs.

However, GPU miners have an efficiency edge at harnessing parallel processing power for slightly better watts to terahashes ratio. Still, ASIC hardware remains vastly more efficient overall through sheer brute force numbers.

Flexibility

When evaluating hardware flexibility, GPU rigs are much more agile to changing needs and new coins. With a vast array of software tools, GPUs using architectures like CUDA and OpenCL can be reconfigured for optimal outputs across dozens of old and new PoW coins fairly easily.

In contrast, ASICs have a fatal flaw – they are created to mine just one or a few algorithms. This leads to issues like Bitcoin ASICs becoming obsolete for mining as difficulty increased. So while performance on a single coin may be better on an ASIC, GPU miners provide superior versatility for mining a portfolio of coins.

Upfront and Operating Costs

Not surprisingly, the upfront hardware CapEx for ASIC rigs generally tends to run higher. Expect to spend $3000 or more to get a decent ASIC miner, although prices fluctuate drastically. Plus GPU rigs can often be pieced together one card at a time.

However, when we analyse operating profitability over a couple year timeframe, ASICs tend to come out far ahead due to their sheer mining dominance. Hundreds of dollars monthly is achievable through Bitcoin or Litecoin ASIC mining. GPU profits are typically 50-75% lower per hardware cost. Power costs even out fairly evenly with GPU rigs having an advantage at very small scales.

Risk Tolerance

When mining any crypto, taking on risk is inevitable. However with ASICs, you compound that risk through less flexibility and reliance on a sole project or algorithm for income security. If that coin tanks or proof-of-work changes, your hardware loses most residual value. This risk is especially dangerous for small hobby miners.

Comparatively, GPU rigs provide a much flatter risk profile by giving you options to switch coins and find the most profitable mining avenue as market conditions change. While still risky overall if mining becomes unprofitable, GPUs provide more stability and protection through adaptability alone.

Other Considerations

Legality – Certain countries have banned or restricted crypto mining, usually targeting ASICs. GPU rigs often fly under the legal radar.

Used Value – There is generally good resale value for used, working GPUs even a couple generations old. ASIC miners tend to have nearly worthless resale value after just one generation.

Noise and Heat – ASIC rigs in particular require very robust cooling and electrical infrastructure to operate which can be noisy and intrusive. GPU rigs produce less concentrated heat.

In summary, while ASIC miners promise faster returns through raw power and efficiency, GPU miners are simpler to get into, more flexible longer term, and less risky as market conditions shift.

Getting Started

As a novice miner, GPU rigs pose less upfront risk, require less operational expertise, and ensure maximum flexibility to pivot across cryptocurrencies and proof-of-work changes. Start with a budget single GPU system, learn the ropes, then scale up responsibly over time for better returns and skill growth.

Leave a Reply